It’s no secret that property markets cycle through highs and lows, but what do these cycles mean for your investment property – or perhaps your next one?

Here’s what you need to know about property cycles in the seemingly endlessly booming Sydney market and how to use them to your advantage.

What is a property cycle?

The price of property has risen across Australia in the long term, but how fast it grows tends to speed up and slow down, forming what is referred to as a “property cycle”. Essentially, this is a series of four phases used to describe the movement of property prices and market activity. It consists of:

- Boom: A phase marked by high property values, peak buyer demand, and a buzzing market. This is often fuelled by factors like population growth, leading to higher demand for real estate and not enough supply to meet this demand. In response, investors and builders are spurred to launch new housing projects.

- Downturn: As the name suggests, this is when the market starts to slow down, and property values may stabilise or even decrease slightly. This deceleration can stem from an influx of new housing outpacing population growth, but it can be due to many other external factors, like a reduction in borrowing capacities.

- Bottom: This is the trough of the cycle – the point where property values and activity are at their lowest. With fewer buyers in the market, property prices may stagnate, decrease or register only marginal growth.

- Recovery: The market starts picking up again as an influx of investors and buyers enter the market to capitalise on lows. This renewed interest amplifies demand, building up to another boom phase.

What causes a property cycle?

A property cycle is driven by several factors, interest rates, living costs, and credit availability to consumer sentiment, government interventions, and other macroeconomic conditions. And then there are unexpected events like the COVID-19 crisis, which disrupted the anticipated upswing and saw housing prices contract in all capital cities.

How long is a property cycle?

Conventionally, property cycles last between 7-10 years. However, regional variances can result in shorter or even extended cycles, sometimes up to 18 years.

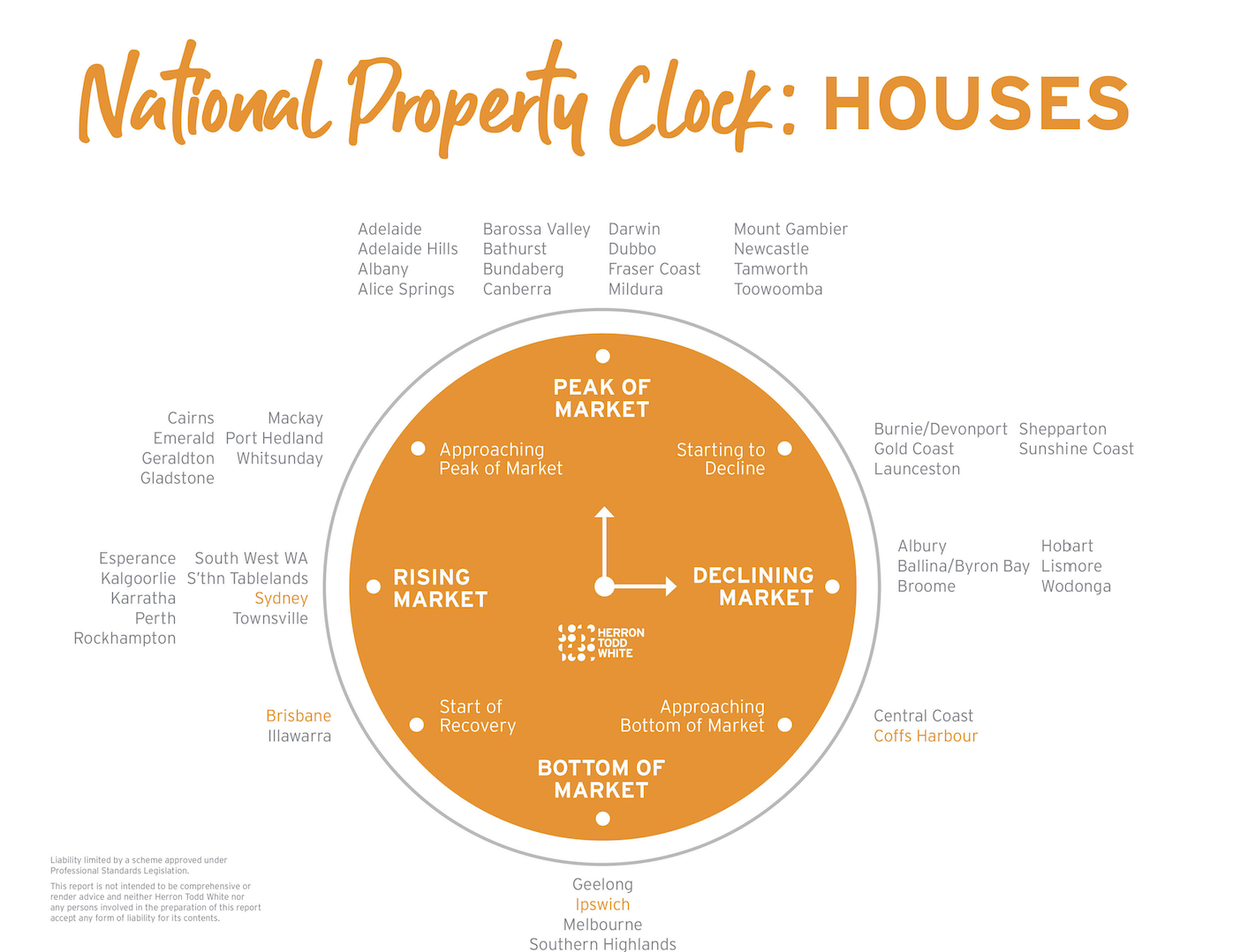

Importantly, there is no single property cycle in Australia. Each state, city, and suburb experiences unique phases due to distinct local factors. While the media might present the national property market as if it were one, the statistics tell a different story. Just take a look at the “Property Clock” graphic below from the latest Herron Todd White monthly report on national property prices. It shows how different cities and regions are at various stages of the property cycle.

How to use this to your advantage

When it comes to “picking” property cycles in Sydney, experts often look to the premium suburbs. Historically, these have been more volatile and therefore, the first to move when there is a change in the market. Price changes then flow outward in what’s known as the ‘ripple effect’. However, the level of growth will vary greatly between suburbs and property type, and what might be considered a “peak” in one suburb might be a trough in another.

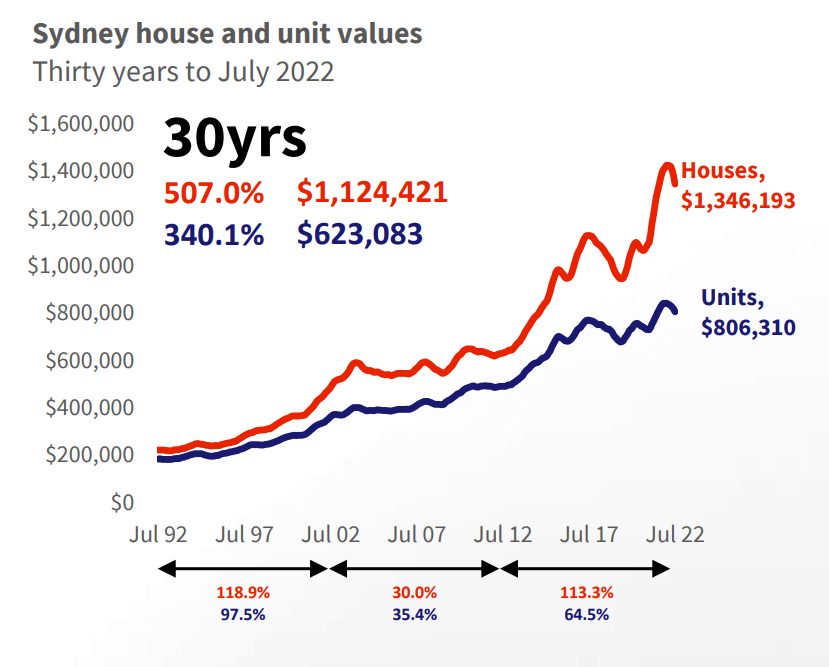

While buying at a low and selling at a peak is the dream of every property investor, the market is incredibly difficult to predict, due to its various influencing factors. History suggests that it’s not so much about timing the market, as time spent in the market. Just look at the below graph, showing the last 30 years of Sydney house and unit values. The data suggests that if you bought property anytime in the last 30 years and held onto it long-term, you’ve seen significant growth.

Source: CoreLogic

Historically, taking a long-term approach to property investing has been the best way to minimise risk, however, if you can achieve that “holy grail” of buying in a downturn and selling in a peak, you will maximise your returns. Just remember, over the years Sydney’s property trajectory has trended upwards so don’t wait too long.

As an investor, talking to real estate agents can be helpful because they’re “on the ground” and will be the first to see market indicators make their move. To gain deeper insights into the Southwest Sydney property market and its nuances, connect with our knowledgeable agents using the contact details below.

The information referred to in this article was obtained from publicly accessible sources from CoreLogic, Domain, KMPG, Canstar, Domain, Herron Todd White and Commonwealth Bank. The information provided in this blog post is for general guidance only and should not be taken as personal advice. We do not accept any liability for any errors or omissions.

Prudential Real Estate Campbelltown | (02) 4628 0033 | campbelltown@prudential.com.au

Prudential Real Estate Liverpool | (02) 9822 5999 | liverpool@prudential.com.au

Prudential Real Estate Macquarie Fields | (02) 9605 5333 | macquariefields@prudential.com.au

Prudential Real Estate Narellan | (02) 4624 4400 | narellan@prudential.com.au